Services

Solutions

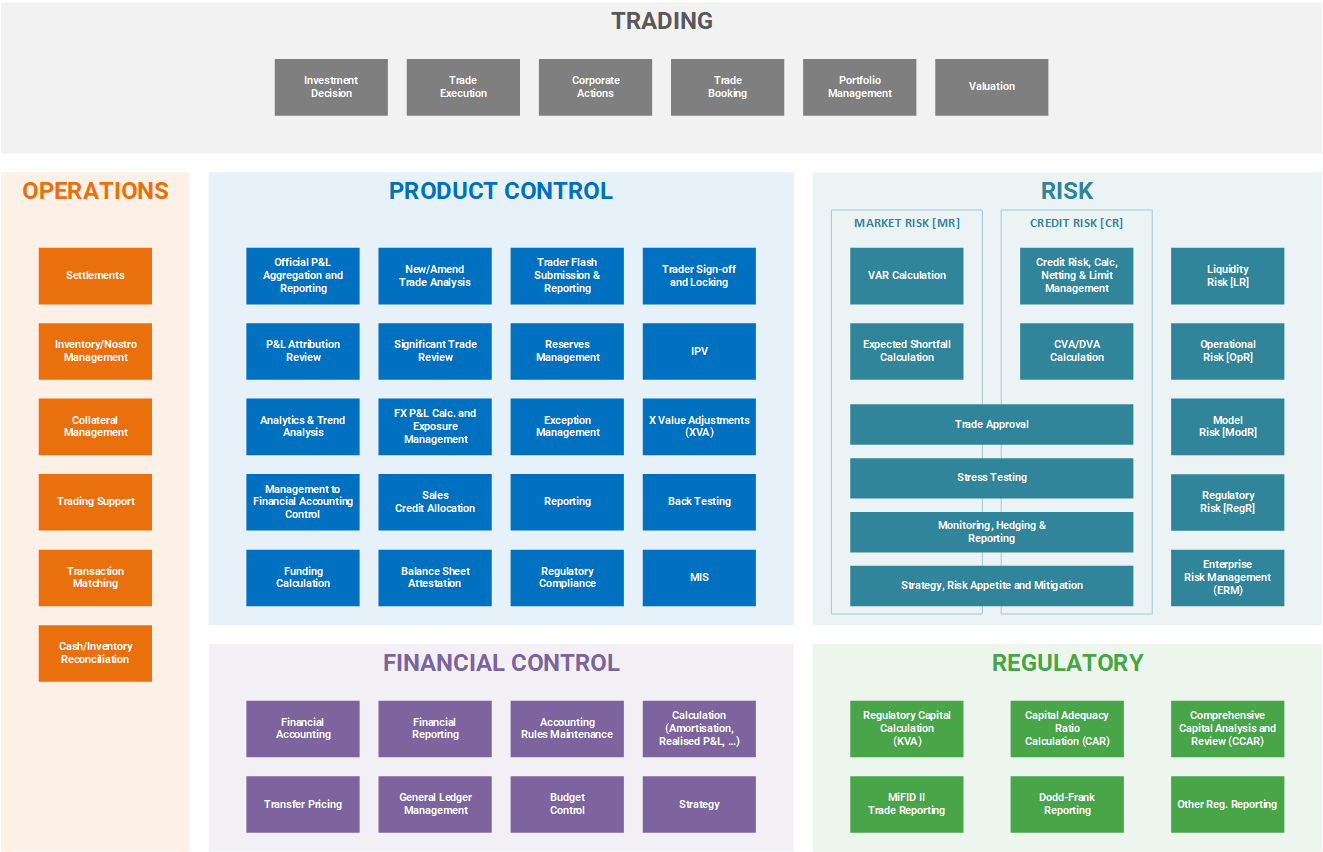

finlytics provides “Next Generation” Investment and Financial Accounting, Control and Regulatory solutions for all investment organisations, from small Funds to major Investment Banks. We have created an information and process eco-system using our industry-proven, “best practice” business models. Combining the latest technology and AI patterns, we deliver technology and advisory services that power and control investment and financial reporting. We cut through complexity, increase efficiency and reduce costs.

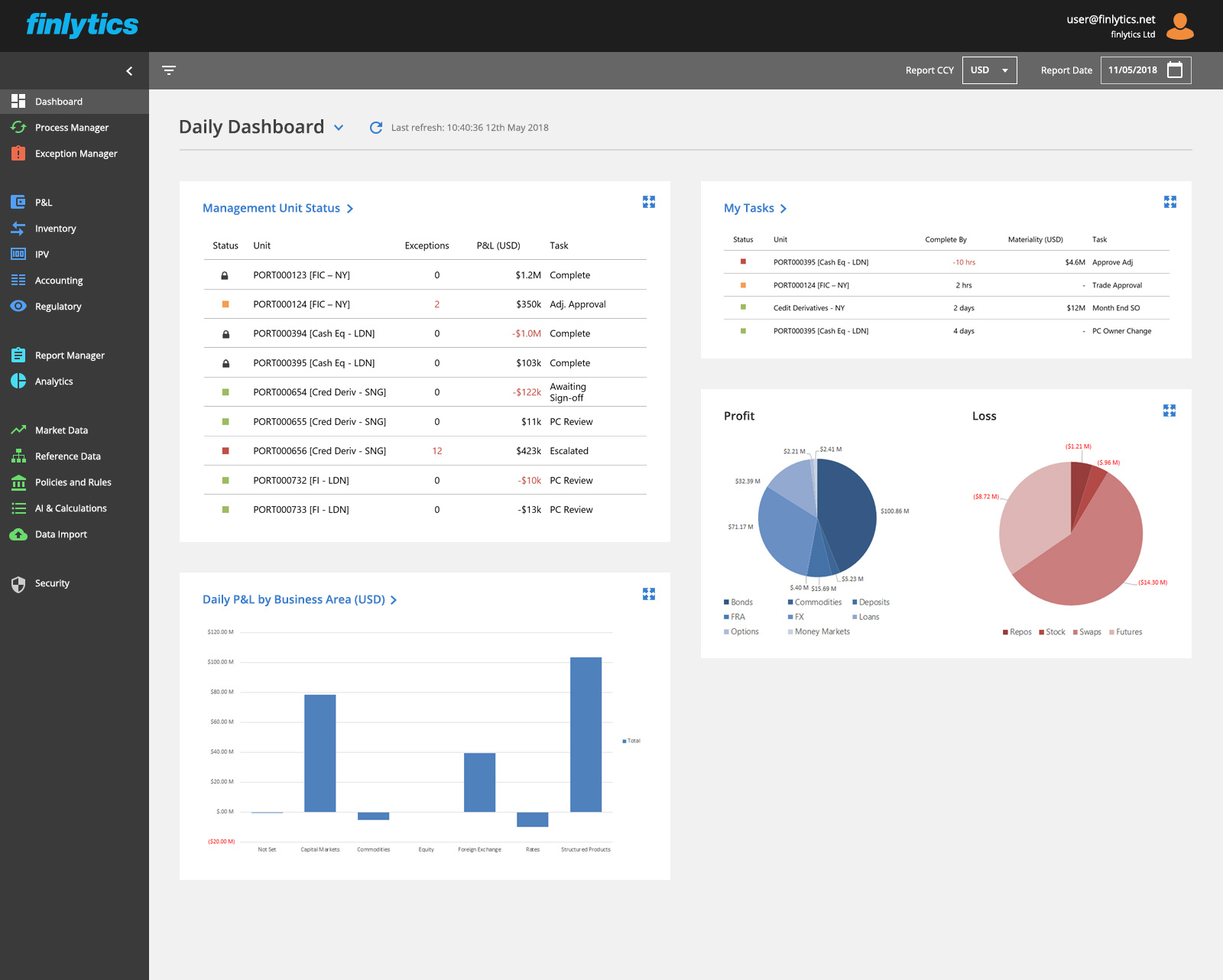

Cross-functional framework to deliver Product Control and Investment Book of Record (IBOR) services. Flash and official P&L sign-off, accounting, reconciliation, MI reporting and analytics. Benefits:

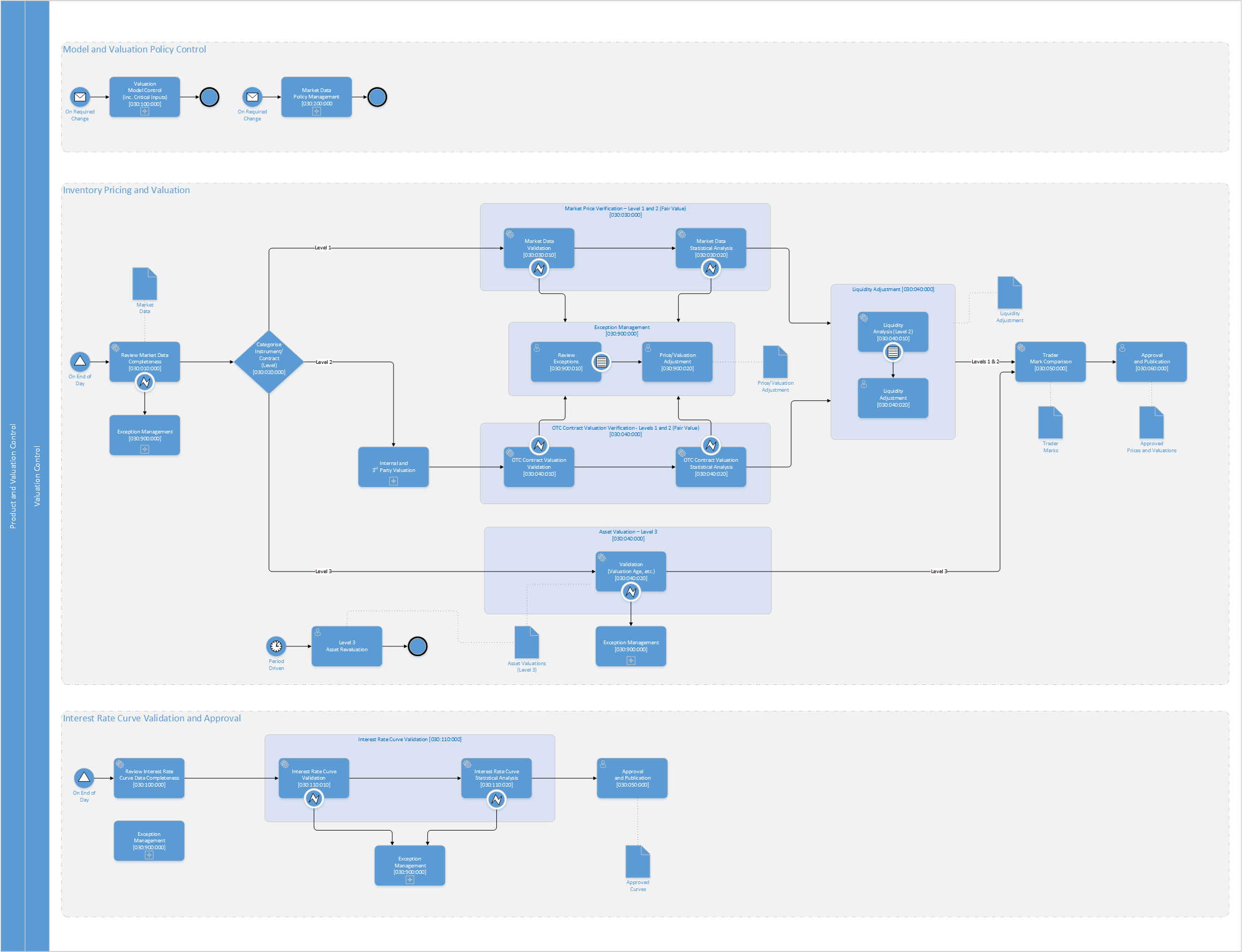

Pre-defined, efficiency-driven business processes to cover all areas of control and reporting functions. Benefits:

We are specialists in moving from strategy to execution; from establishing a clear vision to measuring outcomes, our advisors have the skills and experience to engage with stakeholders and generate valuable artefacts. We:

© finlytics ltd (reg no. 5702393) 2020. All Rights Reserved